The Housing Market Is Gaining Momentum Heading Into 2026

After years of high mortgage rates and cautious buyers, the housing market is finally showing signs of renewed momentum. Sellers are returning, buyers are re-engaging, and for the first time in a while, there’s real movement again.

No, it’s not a surge—but it is a meaningful shift that could set the tone for a stronger market in 2026.

Here are three key trends driving the comeback:

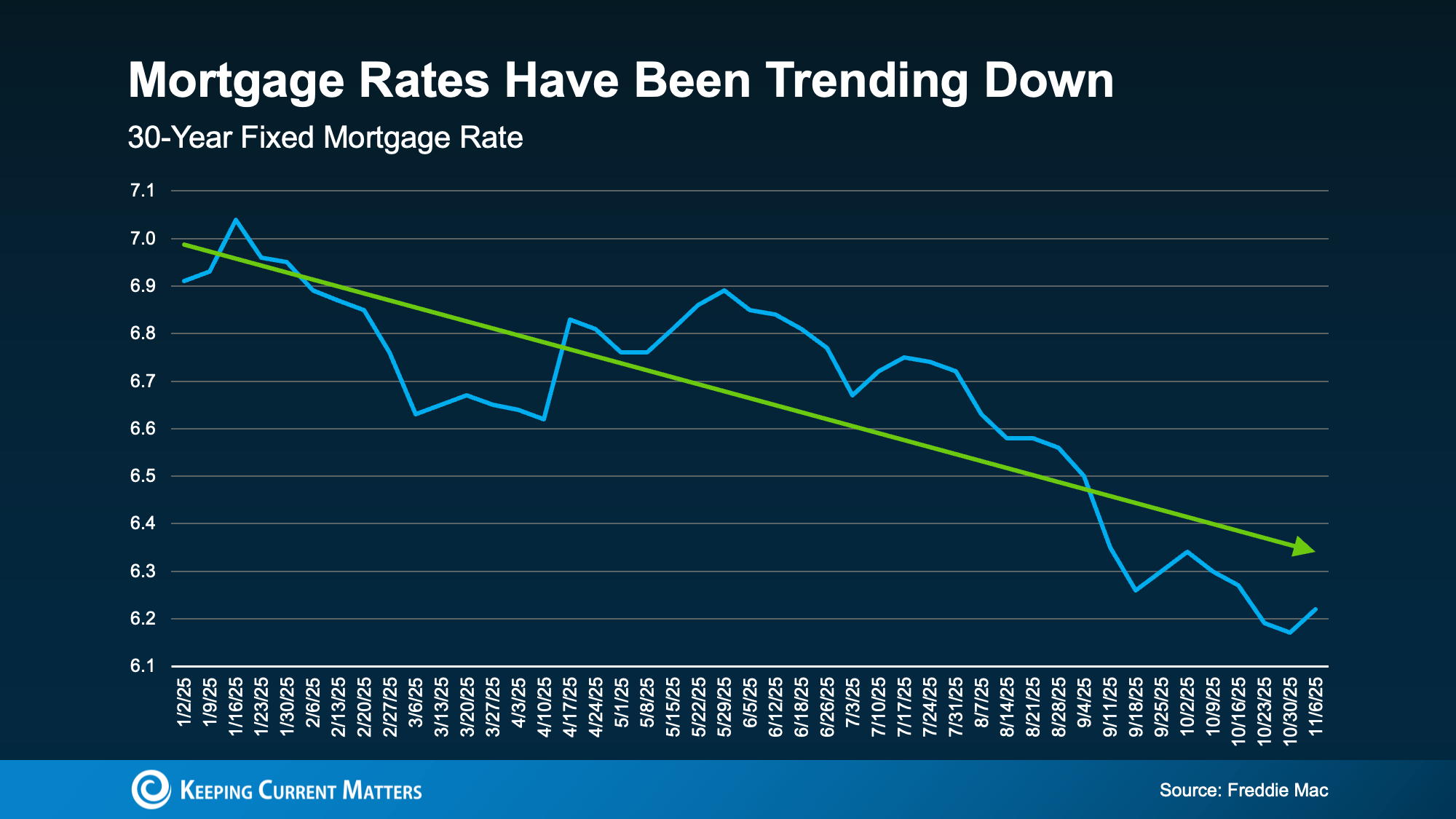

1. Mortgage Rates Are Trending Down

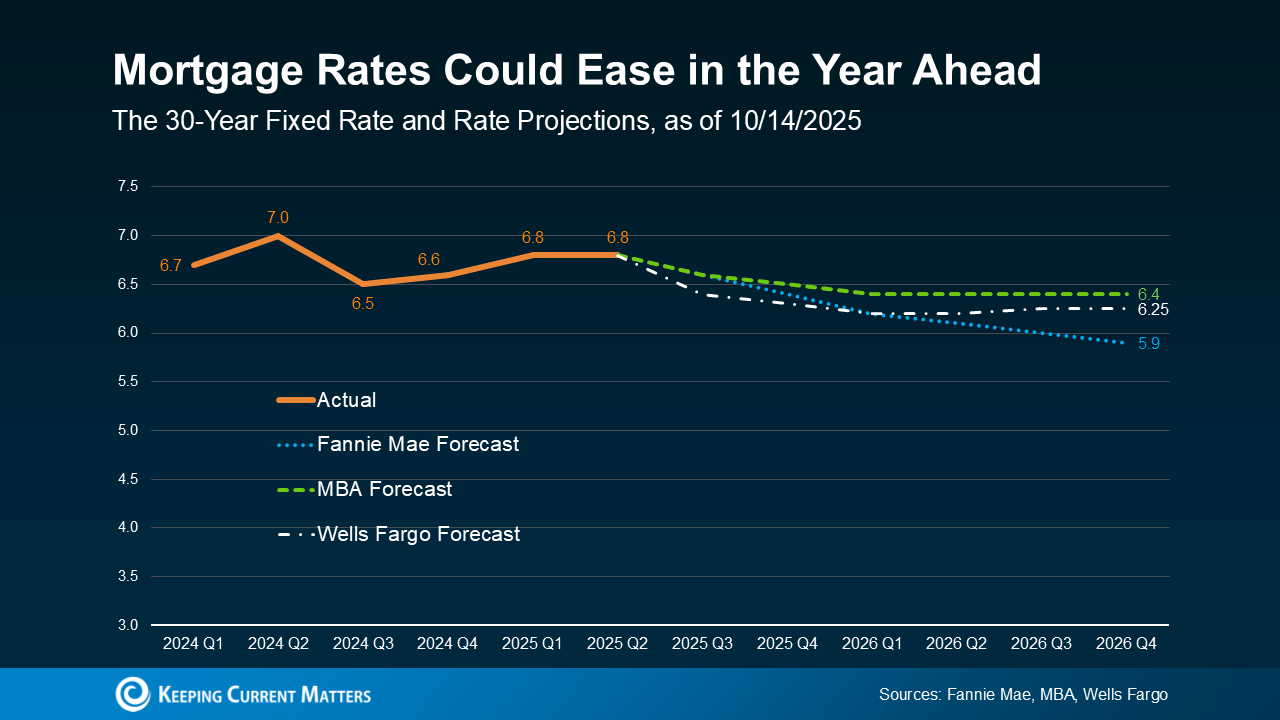

Rates will always fluctuate, especially with today’s economic uncertainty, but the bigger picture is what matters. Overall, mortgage rates have been trending down for most of the year—and the past few months have brought the best rates of 2025.

As Sam Khater, Chief Economist at Freddie Mac, notes:

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

Lower rates mean more buying power. Redfin data shows that a buyer with a $3,000 monthly budget can now afford about $25,000 more home than they could a year ago. That’s one of the reasons activity is picking up.

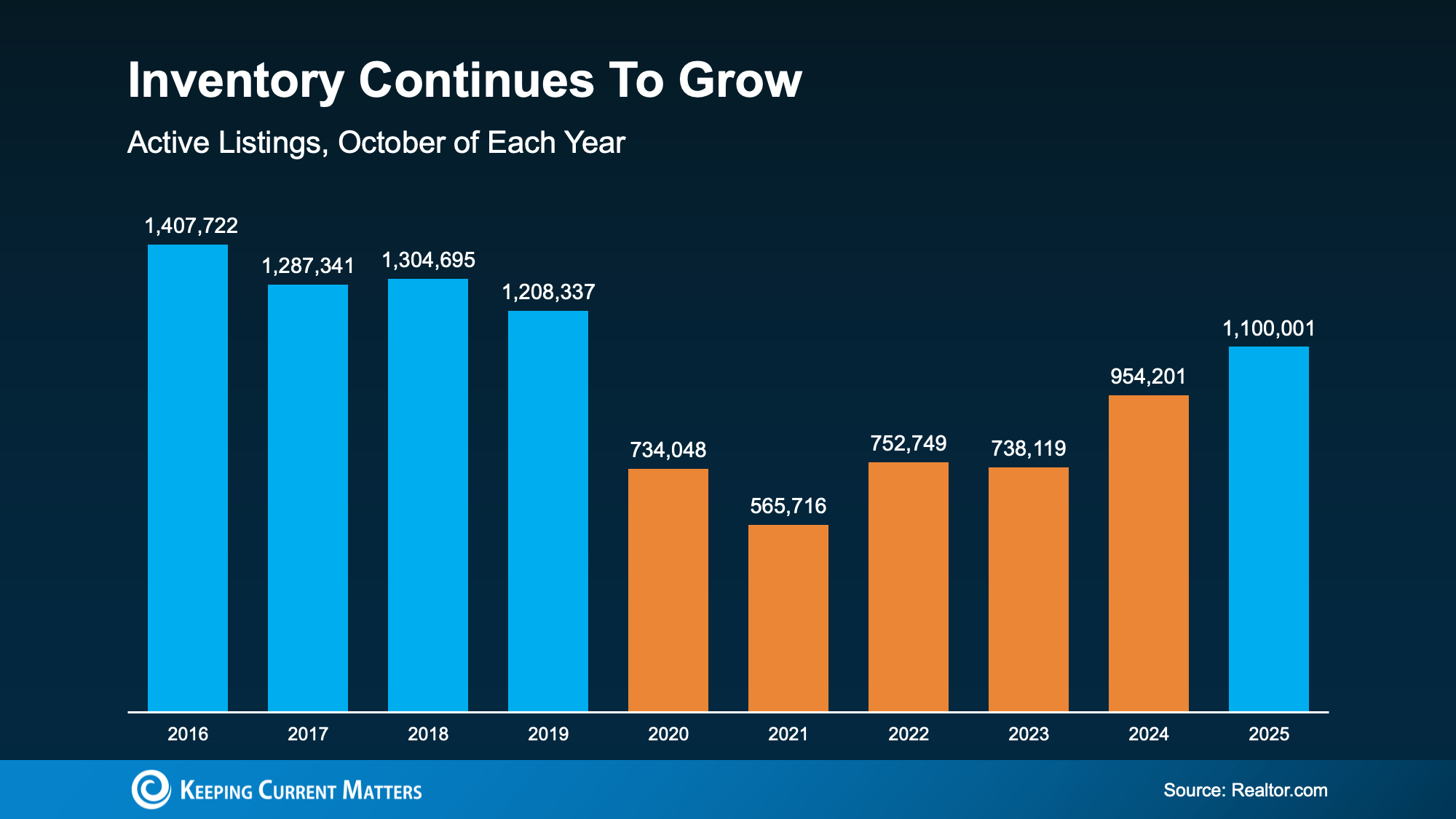

2. More Homeowners Are Listing Again

For years, many homeowners stayed put because they didn’t want to give up their low mortgage rate—creating the “lock-in effect.” But as rates ease, more homeowners are choosing to move for life-driven reasons, and it’s boosting inventory.

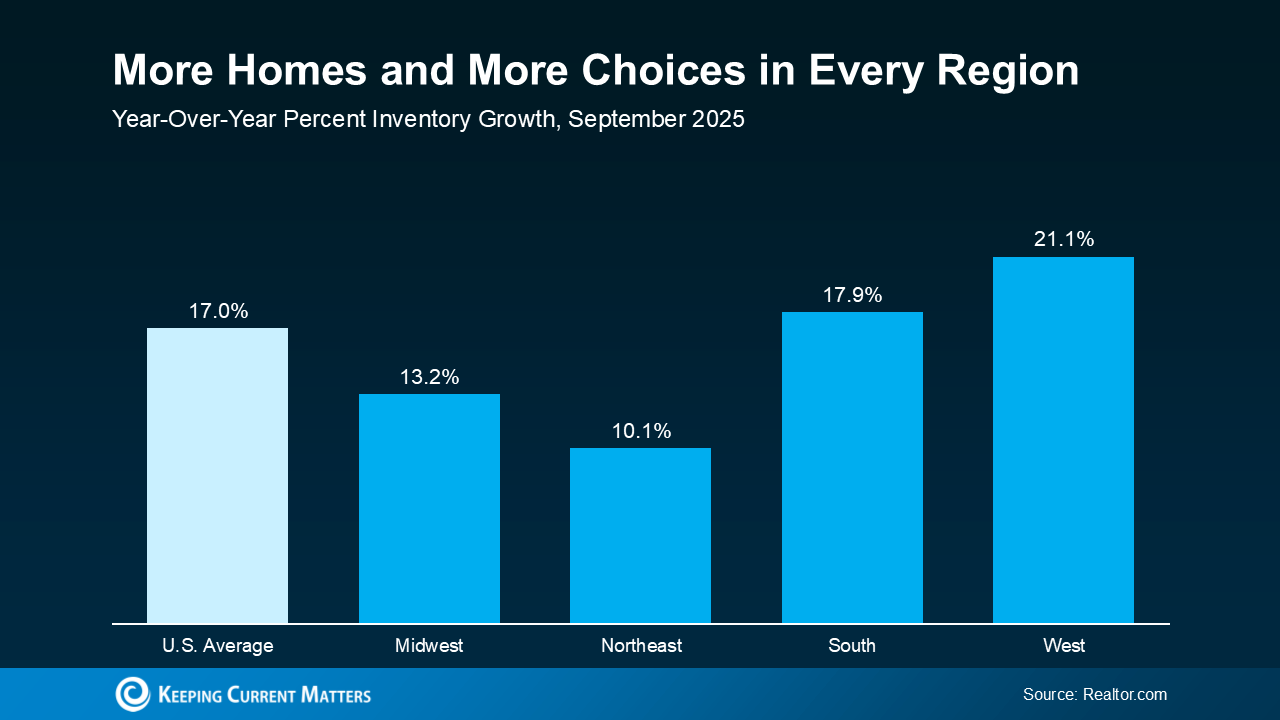

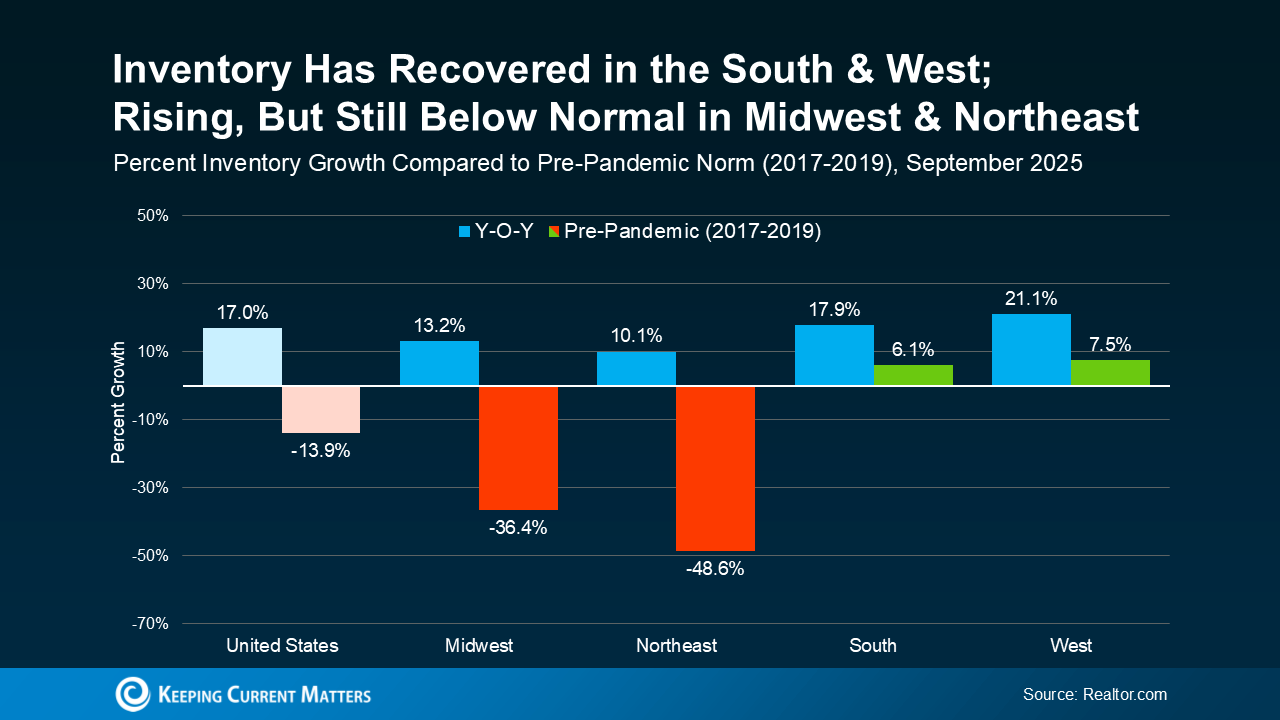

Realtor.com data shows inventory has grown significantly and is approaching levels not seen in six years. This is great news for buyers who’ve had limited options for too long, and it brings the market closer to balance.

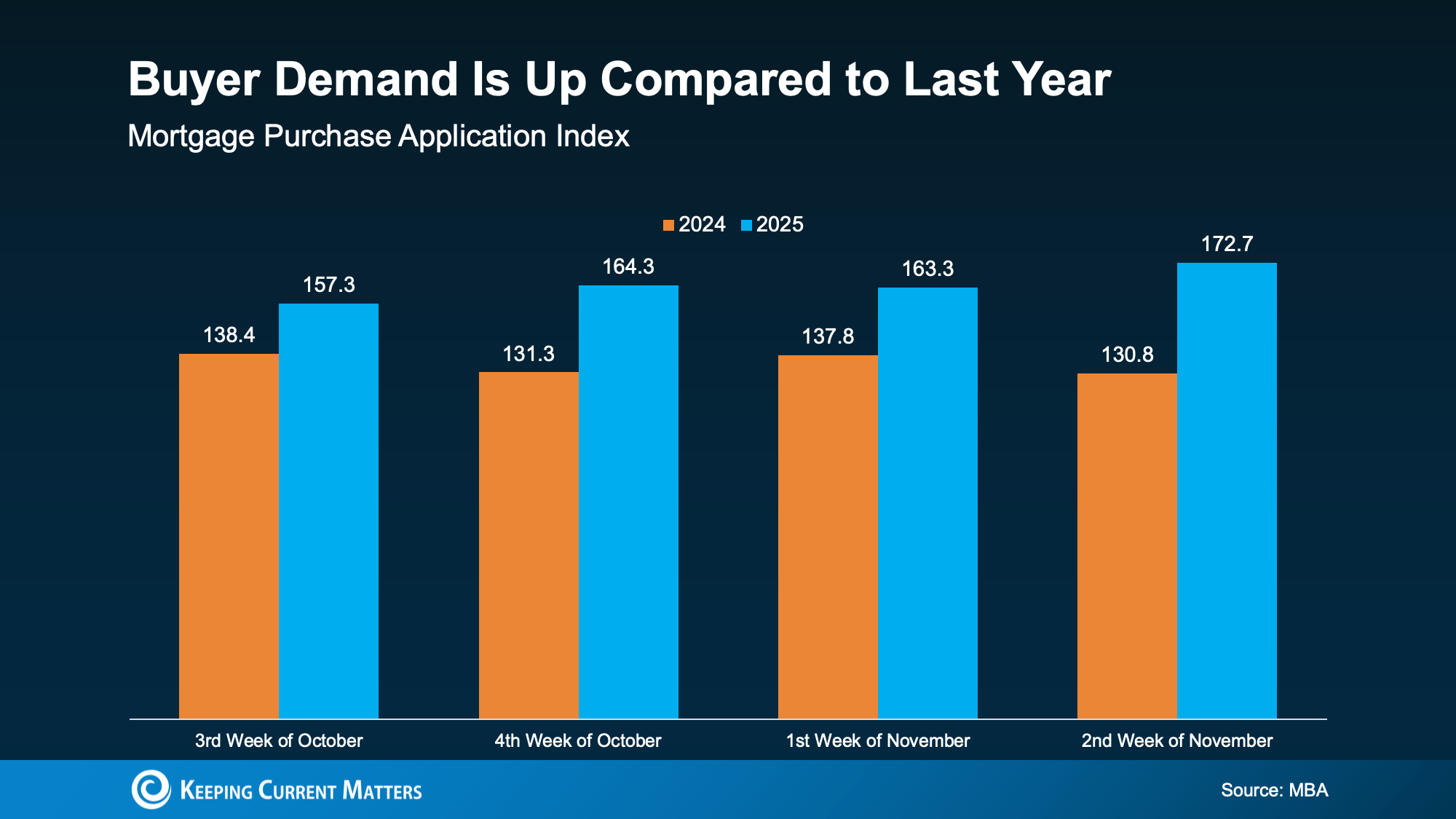

3. Buyers Are Coming Back

With more homes to choose from and slightly improved affordability, buyers are returning as well. The Mortgage Bankers Association reports that purchase applications are up over last year—clear evidence that demand is building.

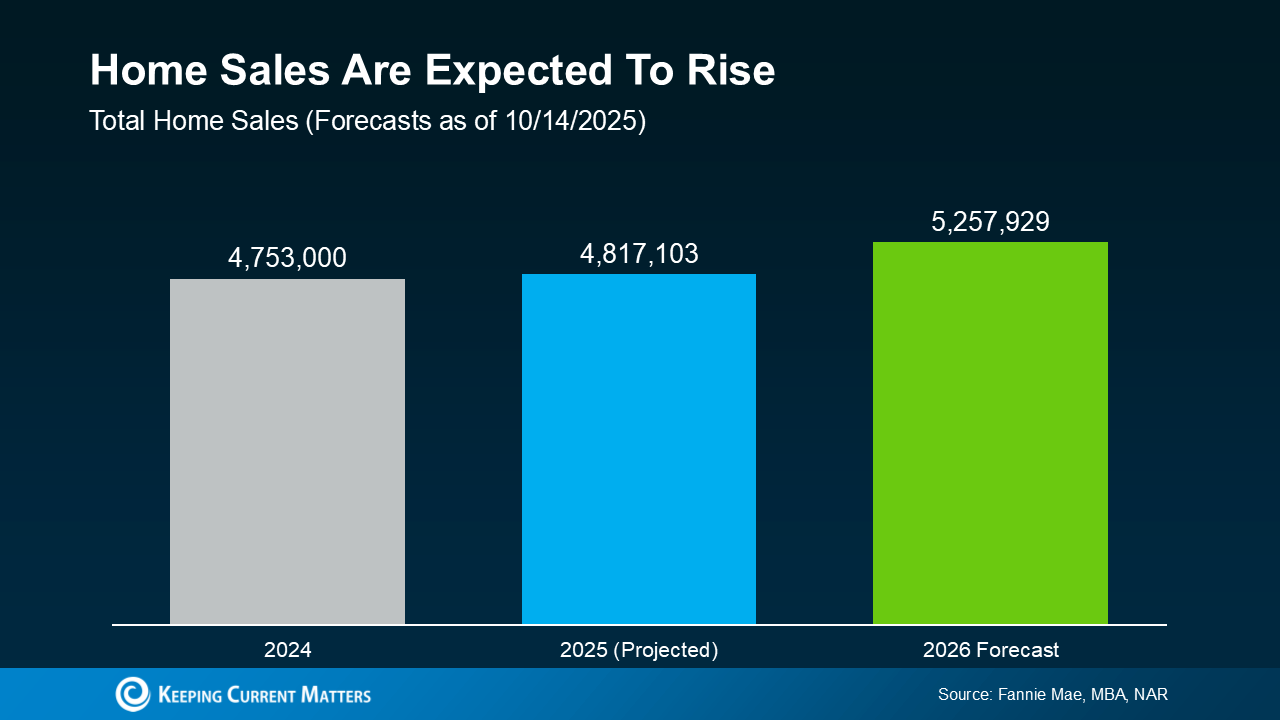

Economists from Fannie Mae, MBA, and NAR all expect moderate sales growth as we move toward 2026.

Bottom Line

After several slower years, the market is finally turning a corner. Falling mortgage rates, rising inventory, and growing buyer demand all point to steady progress ahead.

If you’re thinking about buying or selling, now is a great time to connect with a local real estate agent and plan for what’s coming in 2026.

Do You Know How Much Your House Is Really Worth?

When was the last time you checked your home’s value?

If you’re like most homeowners, probably not as often as you should. And here’s why that matters: your home is likely the biggest financial asset you own — and it’s been quietly growing your wealth in the background.

What’s Home Equity?

Home equity is the difference between what your house is worth today and what you still owe on your mortgage. For example: if your home is worth $500,000 and you owe $200,000, you’ve got $300,000 in equity. That’s real wealth you can use.

In fact, the average homeowner today has around $302,000 in equity, according to CoreLogic.

Why You Probably Have More Than You Think

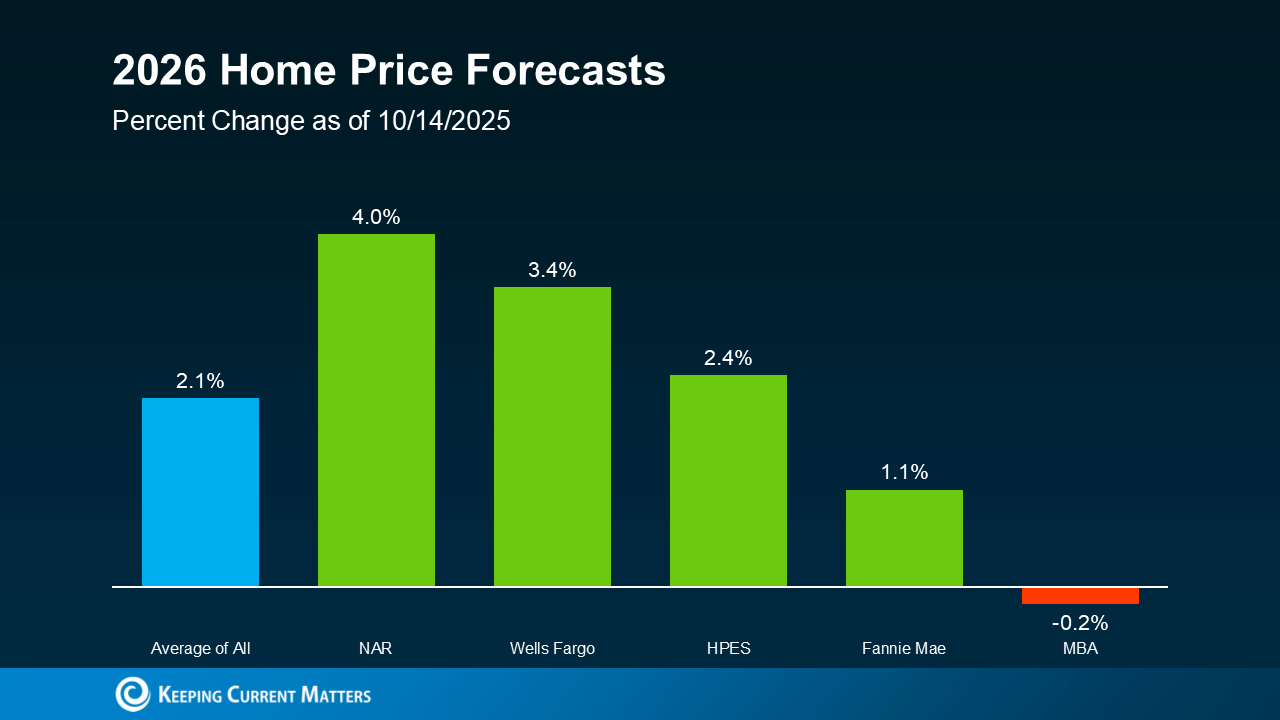

Home prices have soared. Over the past five years, prices are up nearly 54% nationwide. Even with some recent market shifts, long-time homeowners are still sitting on big gains.

People are staying put longer. The typical homeowner stays in their home for about 10 years. That’s a decade of paying down your loan and watching your home’s value climb.

The result? On average, homeowners have gained $201,600 in wealth over the past 10 years just from rising prices.

What Can You Do with Your Equity?

Move Up: Use it as a down payment (or even all cash) for your next home.

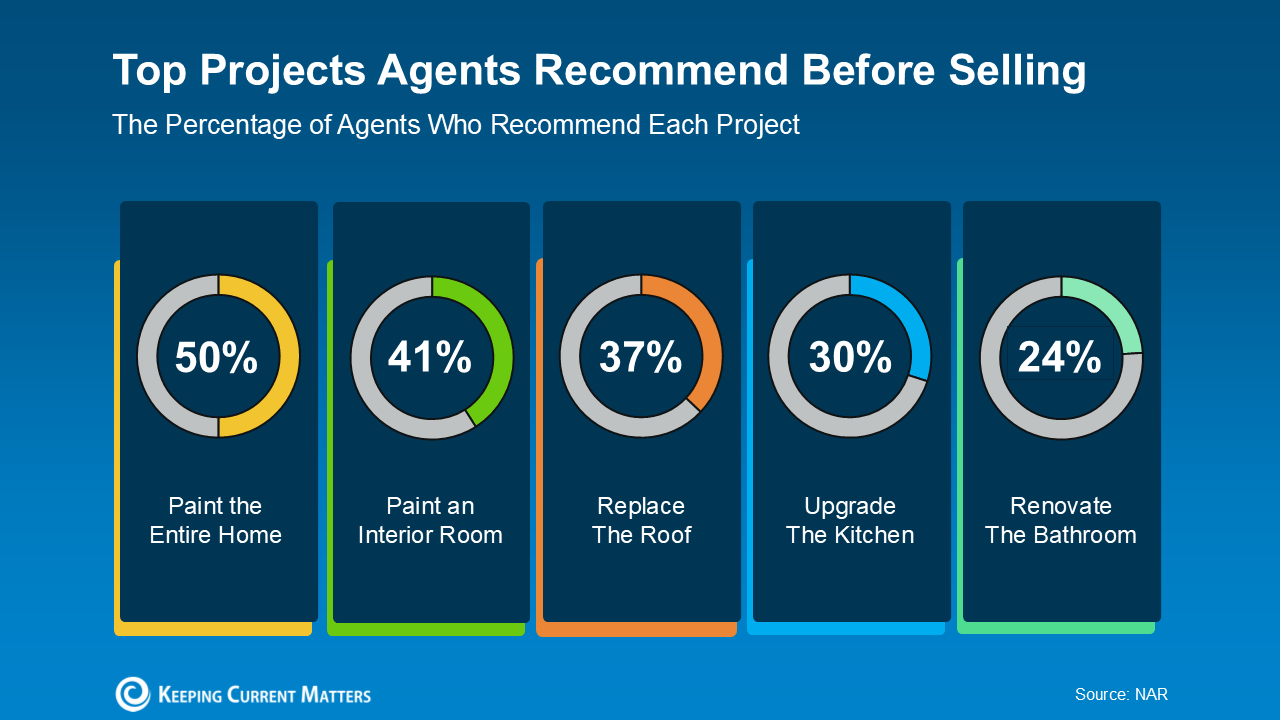

Renovate: Upgrade your space and add even more value.

Invest in Your Dreams: Start a business, pay for education, or boost your retirement savings.

👉Bottom Line

Your house isn’t just where you live — it’s a wealth-building tool. If you’re curious about how much equity you have, reach out to a trusted local agent. You might be surprised at how much your home is really worth.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link