Home Updates That Pay Off When You Sell Your House

Planning to sell this spring? If so, starting your home updates sooner rather than later can make a real difference. While you may be tempted to wait until the first blooms appear or the spring showers hit, by today’s standards, that’s often waiting too long to get started.

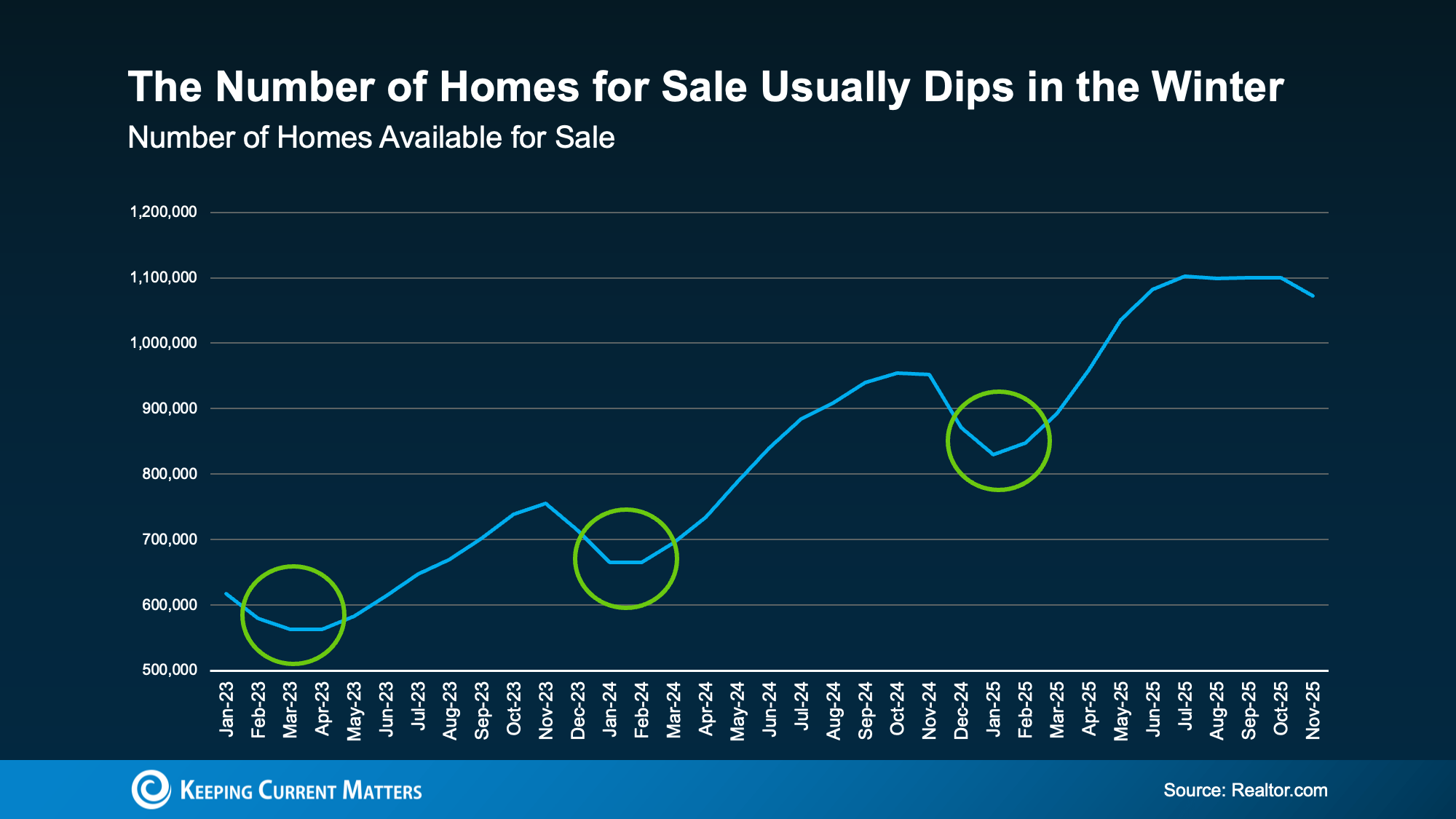

Buyers have more options than they did a few years ago. Therefore, it’s worth it to tackle home updates now and make sure your house is set up to stand out. Because you don’t want to be caught scrambling right before the spring rush. Or, running out of time to do the work your house really needs.

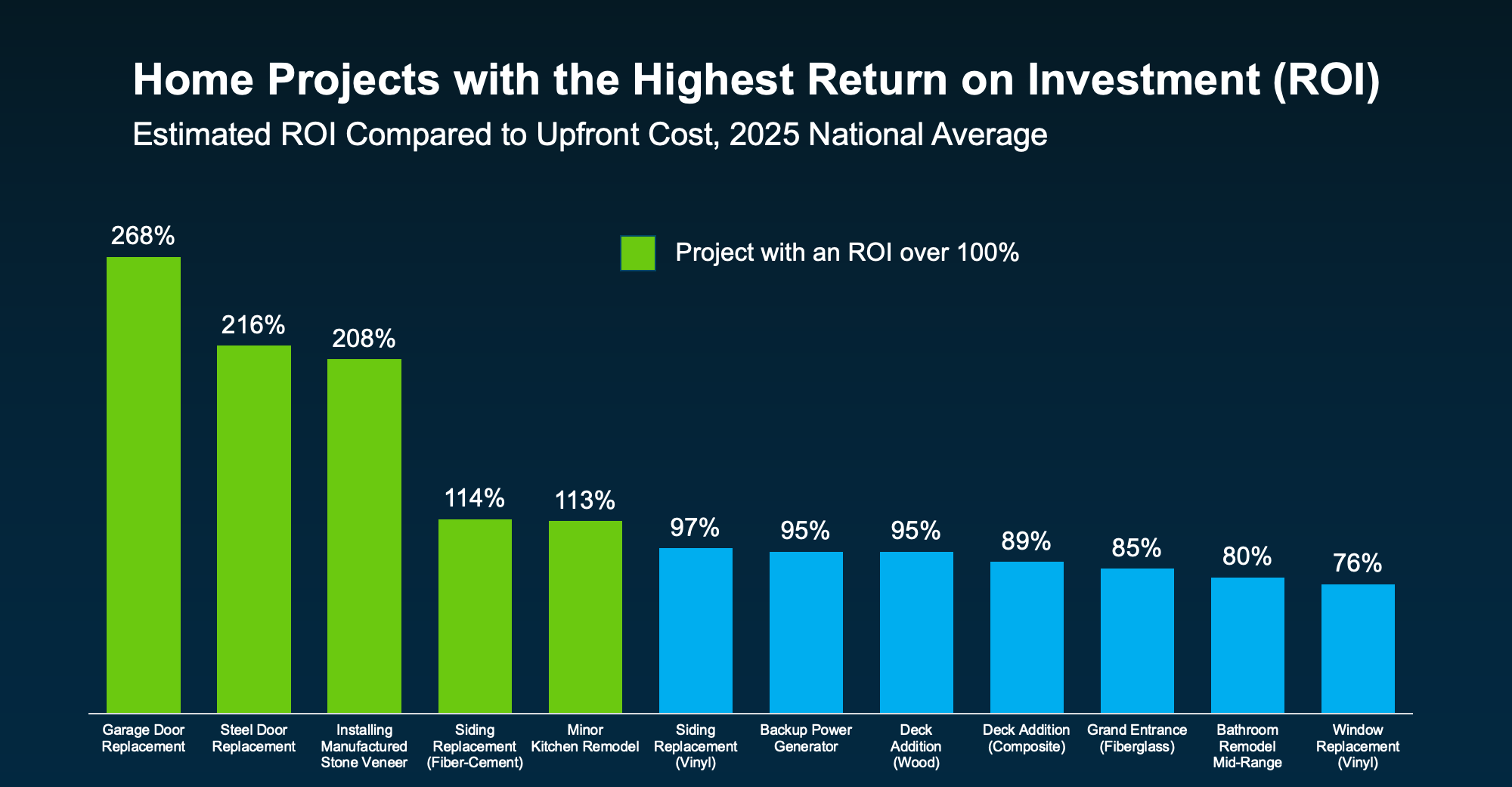

The key is focusing on home improvements that actually matter. And that’s exactly where return-on-investment (ROI) data comes in handy.

Which Projects Tend to Pay Off?

Every year, Zonda looks at which home updates deliver the most bang for the buck when you go to sell the home. And the results can be a little surprising.

The green in the chart below shows the updates where sellers have the biggest potential to add value based on that research:

While there’s a wide range of projects represented in this data, the cool part is, some of the top winners aren’t big to-do’s. They’re just swapping out doors.

Small Updates, Big Visual Impact

This goes to show little projects can have a big impact. So, you don’t have to spend a fortune. And you don’t need to tackle everything on this list. But in today’s market, doing nothing can work against you.

Now that buyers have more homes to choose from, a lot of them are going to opt for what’s move-in ready.

The best advice? Focus on what your house needs, whether it’s listed here or not – like the home updates you’ve been putting off. A front door or shutters in need of a little TLC. Piles of leaves in the yard. Scuffed up paint where your kids play inside. Those details matter too.

Mallory Slesser, Interior designer and Home Stager, explains it to the National Association of Realtors (NAR) this way:

“If you’re looking for affordable updates that pack a punch, dollar for dollar, I would say painting; changing out light fixtures; changing out hardware; maybe new draperies or window treatments. Those are all cost-effective ways to make a big statement. It really changes the space.”

These seemingly small things help buyers focus on the home itself – not the work they think they’ll have to do after moving in. And that’s paying off for other sellers. Buyers are often willing to spend more on homes that feel well cared for, updated, and move-in ready.

This Chart Is a Starting Point, Not a Strategy

Here’s the important thing to remember. National data like this is a guideline. Buyer preferences are going to vary by location, price point, and even neighborhood. That means a project that boosts value in one area might be unnecessary (or even overkill) in yours.

That’s why the first step should always be to talk with a local real estate professional before you start.

An experienced agent can help you answer questions like:

- Which updates do buyers in your market expect?

- What can you skip without hurting your sale?

- Where will a small investment make the biggest difference?

- Is it better to update, or sell as-is?

That guidance helps you avoid over-improving and under-preparing.

Bottom Line

If you’re looking to sell this spring, you still have time to make updates that help your home stand out – without taking on a full renovation.

The Top 2 Things Homeowners Need To Know Before Selling

Here’s something every homeowner should know before selling: in today’s market, the sellers who win aren’t the ones sitting on the sidelines—they’re the ones who set the right strategy from the very beginning.

Many sellers this year didn’t get the results they hoped for. But it wasn’t because the market failed them. It was because their expectations didn’t match today’s reality.

Realtor.com reports that 57% more homes were taken off the market this year compared to last. That means they listed… but never sold. And the truth is, most of those missed sales came down to two things: pricing and timing.

Here are the top lessons you can take from those sellers:

1. Price It Right from the Start

Pricing is the biggest factor that makes or breaks a sale.

Today, 8 in 10 sellers expect to get their asking price or more—but the data tells a different story. Redfin reports that only 1 in 4 sellers (25.3%) are actually getting above list price.

A few years ago, you could list high and still attract multiple offers. But today’s buyers have more choices, and they’re being picky. If your home is even slightly overpriced, they’ll skip right past it.

Some sellers end up pulling their listings altogether—when all they really needed was a small price adjustment.

According to HousingWire, the average price reduction right now is just 4%.

That’s it. Just 4%.

If those sellers had priced 4% lower from day one, they may have already sold their home—smoothly and successfully.

Before you list, talk with your agent about how homes in your area are performing. The right agent will help you land on a competitive price that attracts buyers while still protecting your equity. And if you’ve owned your home for a while, your equity likely gives you the flexibility to price smartly and still come out ahead—something many sellers overlook.

2. Don’t Expect Overnight Results

Another common mistake: thinking your home will sell in a single weekend.

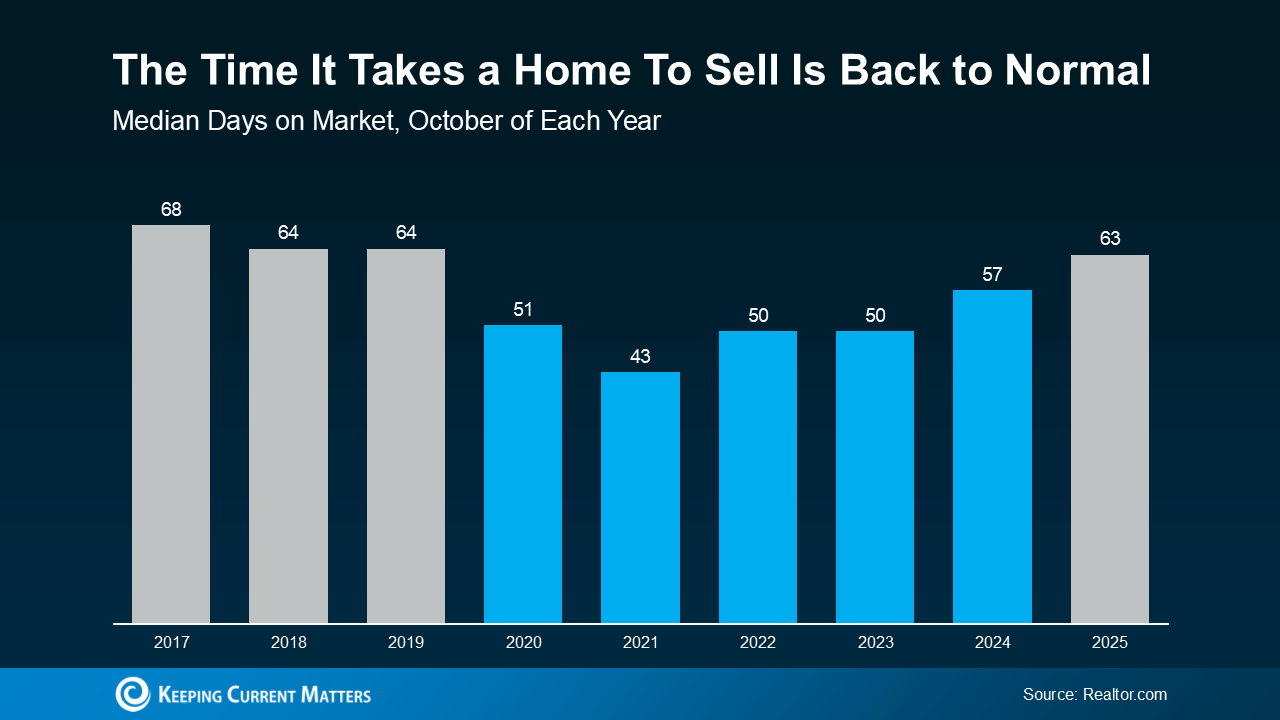

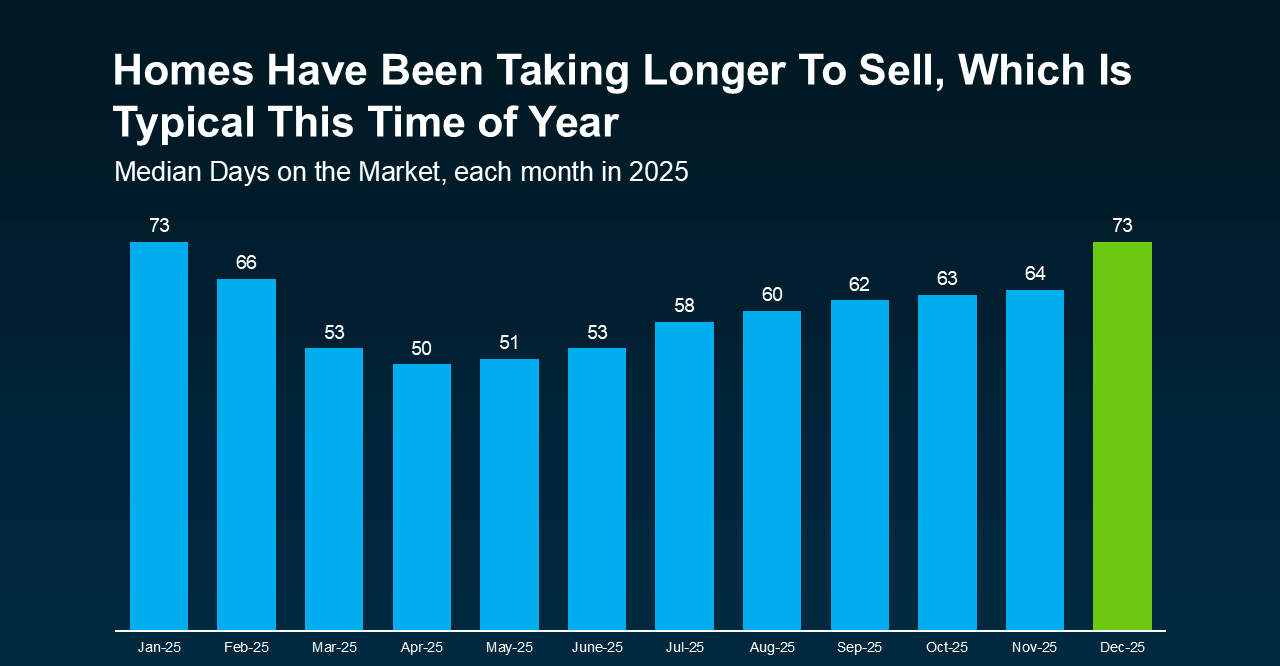

A lot of sellers still compare today’s market to the frenzy of 2020–2021, when homes were selling within hours. But those days are gone.

Right now, it takes around 60 days from listing to closing—that’s normal. It only feels slow because we’re comparing it to an unusually fast period in real estate.

Buyers today are more thoughtful and intentional. They’re taking their time to compare homes, explore options, and make confident decisions—which is actually a sign of a healthier market.

So if your home doesn’t go under contract immediately, don’t panic. It doesn’t mean it won’t sell.

To make your home stand out sooner rather than later, ask your agent about the best strategies—like staging, decluttering, professional photos, or strategic pricing—to attract serious buyers quickly.

Bottom Line

If you’re planning to sell, don’t let the headlines worry you. Let the market be your guide.

The listings that didn’t sell this year weren’t failures—they just started with the wrong strategy.

With the right price, the right timing, and a trusted local agent, you can position your home to succeed.

Because in today’s market, winning isn’t about waiting for things to change—it’s about setting the right expectations from day one.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

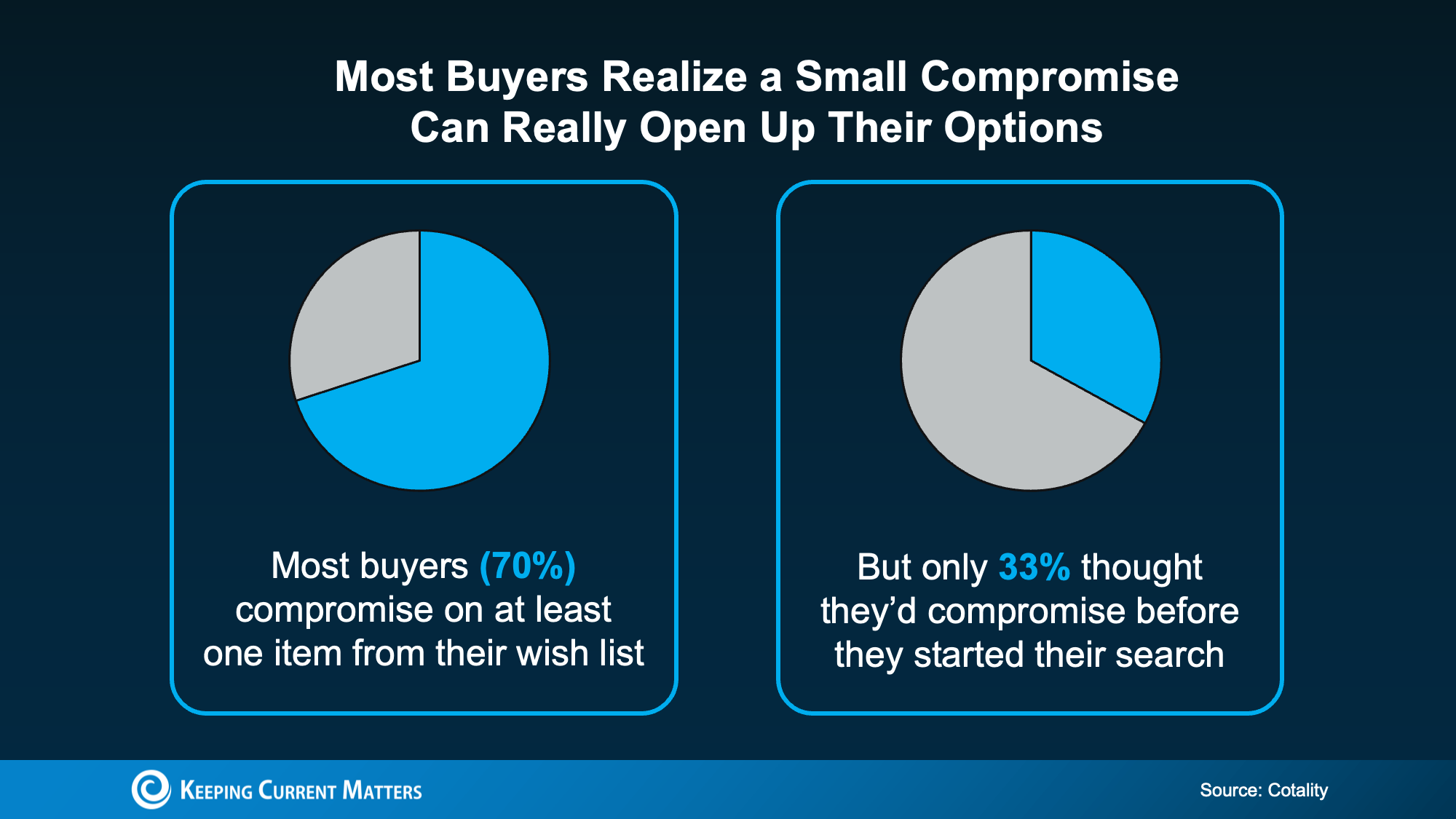

What changed? Buyers discovered something important during the search. The features you can’t change matter far more than the ones you can update later.

What changed? Buyers discovered something important during the search. The features you can’t change matter far more than the ones you can update later.