If you’re like a lot of homeowners, you’ve probably thought: “I’d like to move… but I don’t want to give up my 3% rate.” That’s understandable. That rate has been one of your biggest financial wins – and it’s tough to let it go. But here’s the thing…

A great rate won’t fix a home that no longer fits your life. Things change, and sometimes your home has to change with them. And you’re not alone in feeling that way.

The Lock-In Effect Is Starting To Ease

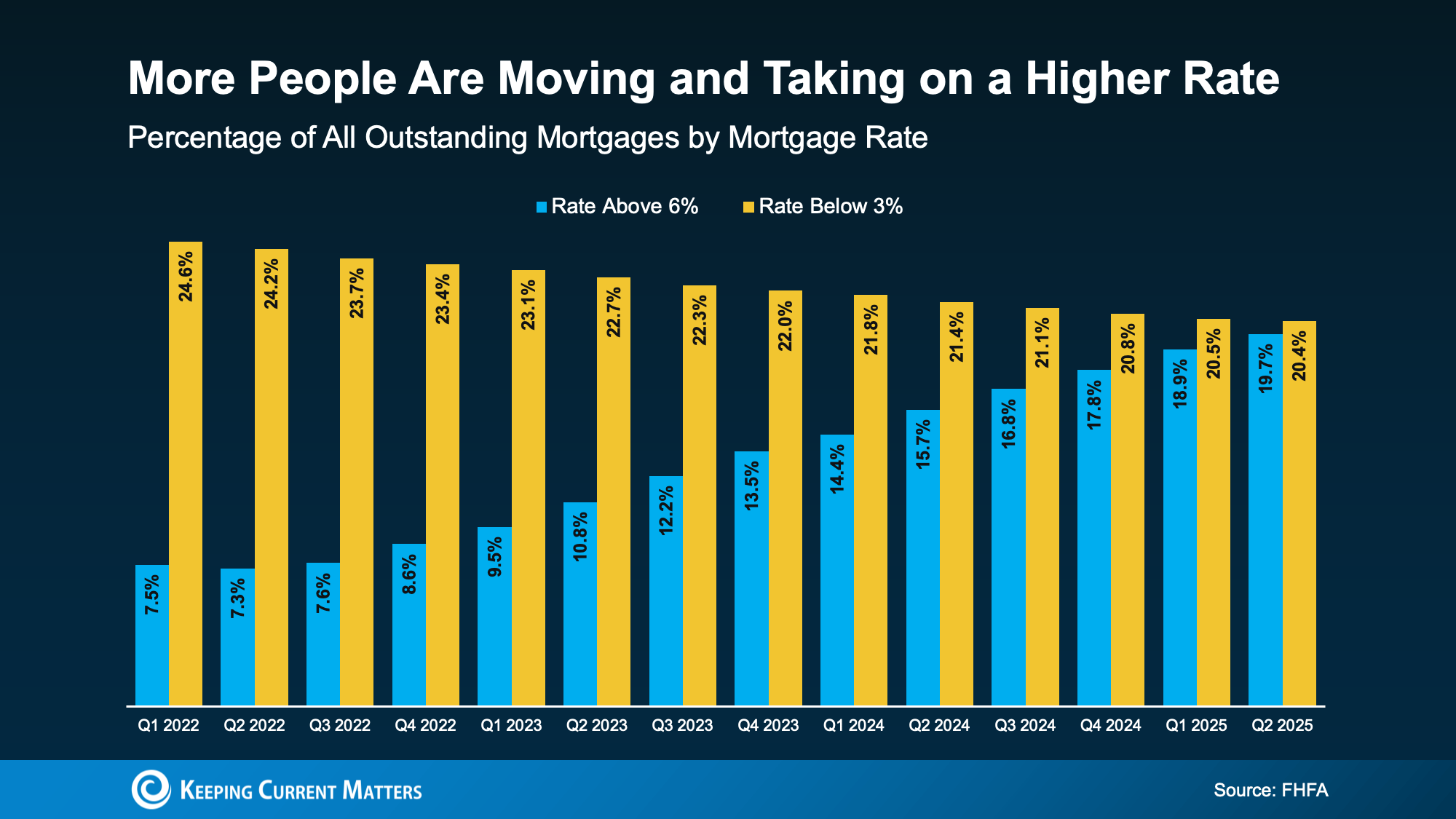

Many homeowners have been staying put because of what experts call the lock-in effect – not wanting to move and take on a higher rate. But data from the Federal Housing Finance Agency (FHFA) shows that this lock-in effect is gradually easing.

The share of homeowners with rates below 3% (the yellow in the graph) is slowly shrinking as more people decide to move. Meanwhile, the number of homeowners taking on rates above 6% (the blue) is increasing as they buy their next home:

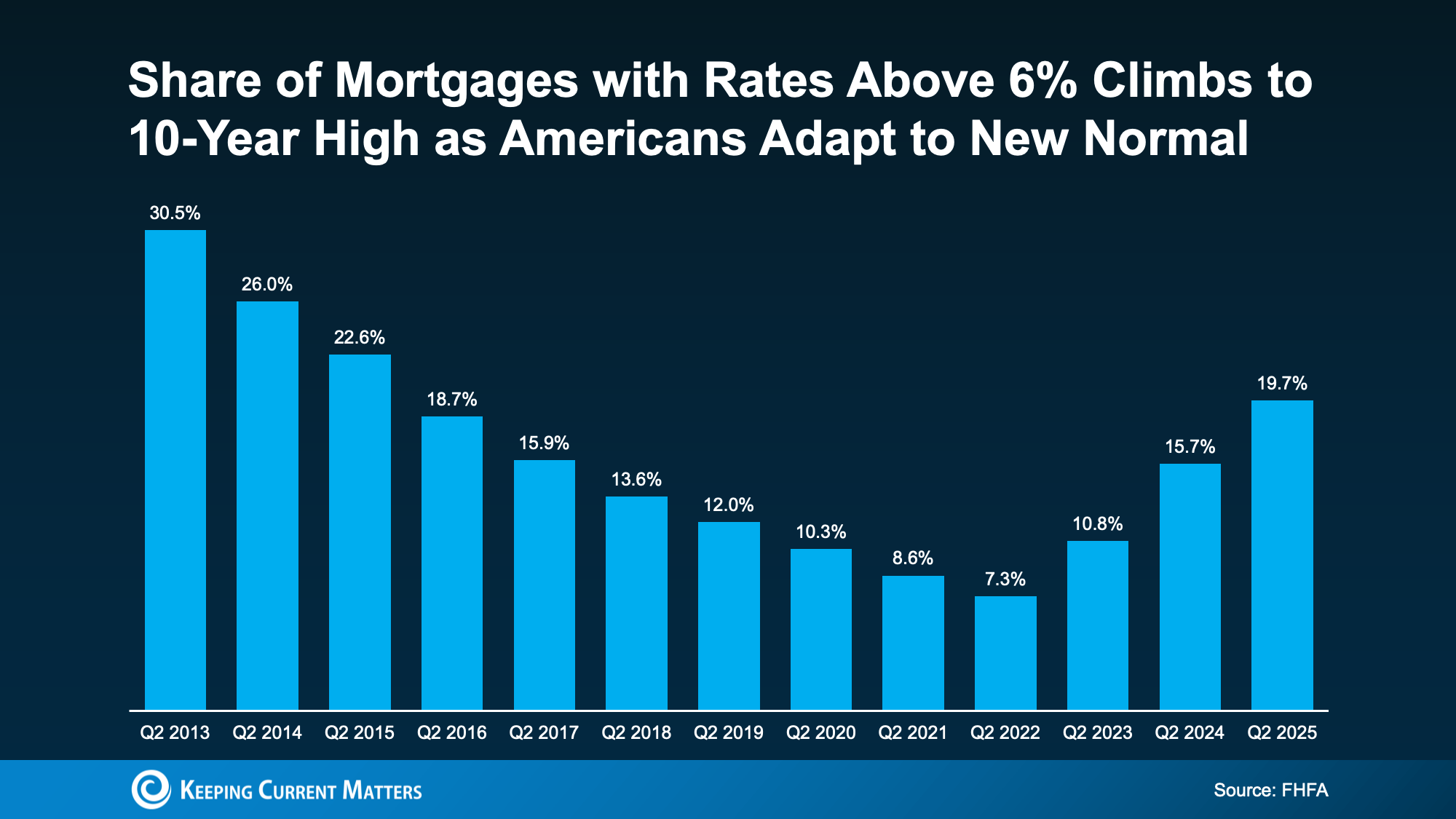

And while the change may look subtle, it’s actually a significant shift. The share of mortgages above 6% just reached a 10-year high (see graph below). This shows that more people are adjusting to today’s rates as the new normal.

Why Are More People Moving Now, Even with Higher Rates?

Simple — they can’t put their life on hold any longer. Families expand, jobs shift, priorities evolve, and a house that once felt perfect might not work at all anymore — even if the rate is fantastic. And that’s okay. As Chen Zhao, Head of Economic Research at Redfin, says:

“More homeowners are deciding it’s worth moving even if it means giving up a lower mortgage rate. Life doesn’t standstill—people get new jobs, grow their families, downsize after retirement, or simply want to live in a different neighborhood. Those needs are starting to outweigh the financial benefit of clinging to a rock-bottom mortgage rate.”

First American calls these major life drivers the 5 Ds:

Diplomas: As your income grows with higher education and career advancement, your buying power expands — and you may be ready to move up from your first home.

Diapers: Your family is growing, and your current home may no longer meet your needs.

Divorce: Whether ending or beginning a marriage, life changes can create the need for a new home.

Downsizing: With kids out of the house, a smaller, easier-to-maintain home may be calling your name.

Death: Losing someone often brings clarity about wanting to live closer to loved ones.

Whatever your reason, consider this: yes, your low rate is great. But staying put might mean keeping your life on pause — and that may not be working anymore.

Realtor.com says nearly 2 in 3 potential sellers have already been thinking about moving for over a year. That’s a long time to delay your goals, your next chapter, and your family’s needs. So maybe the real question isn’t: “Should I move?”

It’s: “How much longer am I willing to stay in a home that no longer fits my life?”

Rates have already come down from their peak earlier this year. And they’re projected to ease a bit more in 2026. Combine that with your real-life motivations, and it might finally be enough to help you move forward.

Bottom Line

Life doesn’t wait for the perfect rate. Maybe you shouldn’t either.

With rates dipping from their highs and expected to soften slightly more in 2026, moving could be more realistic than you think. If you’re ready to explore your options, reach out to a local agent and lender.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link