Renting often feels cheaper and more convenient than buying a home—especially right now. No repairs, no property taxes, no stressing about mortgage rates. You simply pay your rent and move on.

But here’s what most people overlook: renting doesn’t build your financial future. Homeowners, on the other hand, grow their net worth just by owning a home.

If you’ve been questioning whether buying is still worth it, the long-term numbers make the answer clearer than you might expect.

Renting vs. Owning: The Real Difference

When you rent, your payment goes straight to your landlord and disappears. When you own a home, a portion of your payment comes back to you in the form of equity — the wealth you gain as your home appreciates and your loan balance decreases.

So while renting may feel more affordable today, it comes with a long-term cost: missed wealth-building opportunities.

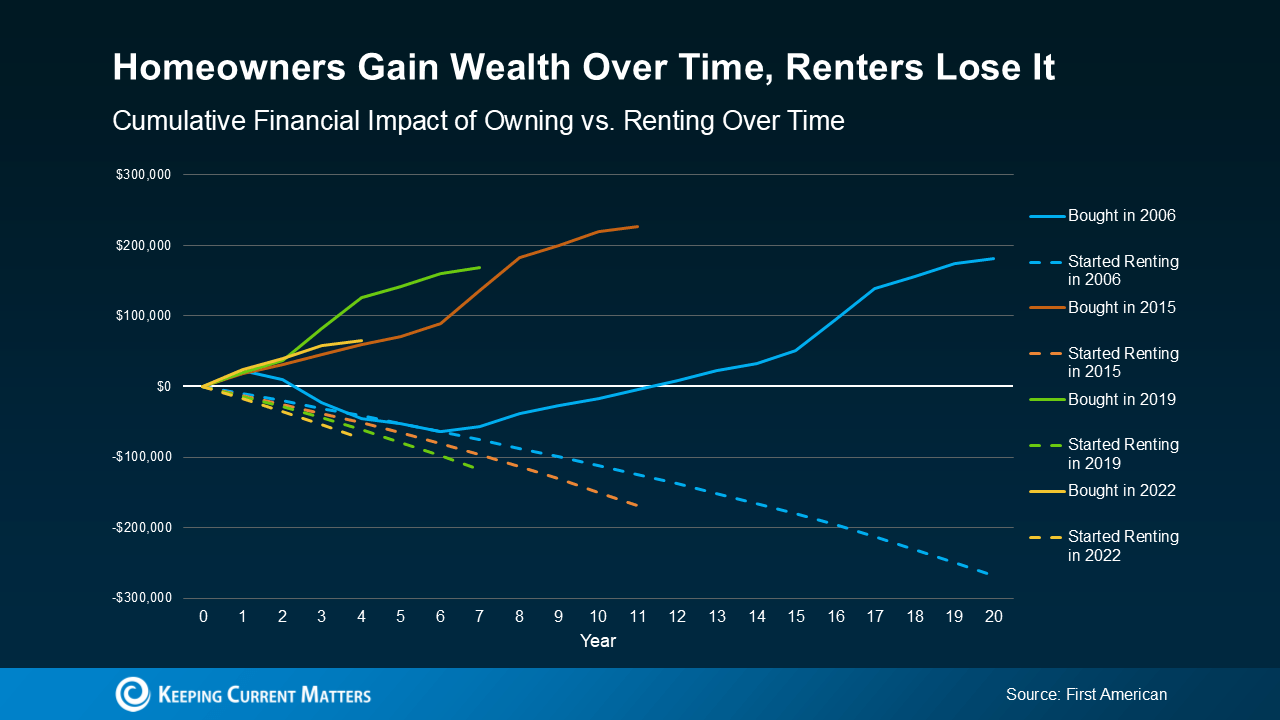

First American recently compared the long-term financial impact of renting versus owning across different time periods — 2006, 2015, 2019, and 2022. They factored in mortgage payments, taxes, insurance, repairs, and maintenance versus the equity gained from owning.

Across every time frame, two things were consistent:

Renters lost money over time, while homeowners gained it.

Their data showed homeowners steadily increased their net worth the longer they stayed in their home, while renters continued to spend without any financial return.

The Bottom Line: Time Builds Wealth

Owning a home grows your wealth. Renting doesn’t. And even when you account for homeowner expenses, buying came out ahead in every period the study measured.

That doesn’t mean owning is always cheaper in the short term — but over time, the wealth gap between renting and owning widens significantly.

Affordability Is Slowly Improving

If buying still feels out of reach, you’re not alone. The last few years have been tough for buyers. But things are shifting: mortgage rates have eased, home prices are cooling, and incomes have risen. According to Zillow, typical monthly payments are slightly more manageable than they were a year ago — not dramatically, but enough to matter.

Buying may not be easy right now, but it is becoming more doable. And in the long run, it’s almost always worth it.

Final Thoughts

Renting might feel simpler today, but owning is what builds long-term wealth. With affordability improving, the path to homeownership may be more within reach than you think.

If you’re curious what buying could look like for you, connect with a trusted local real estate professional who can guide you through your options—no pressure.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link